Investment Proposal

Presented by Ph. D. Ying XY

Namax Pharmaceutical (Proprietary) Limited

Email: namaxpharma@gmail.com

Introduction

“Lick Hang” established a joint venture with the Namax Pharmaceutical (Proprietary) Limited (“Namax”) in Namibia. Namax is a company incorporated in March 2014 and is engaged in the supply of medical and pharmaceutical products in Namibia and SADC. The company is 100% owned by Namax International Limited, a Hong Kong registered company.

Namax has also registered the relevant trademarks, copyright ad logos with the Ministry of Industrialization, Trade and SME Development (MITSMED).

Namax is also listed in the Central Medical Stores (CMS) procurement system, as a qualified supplier. And, for the past 3 years, we have been supplying more than 50 products to the Ministry of Health and Social Services (MoHSS).

Namas is affiliated to 10 Chinese Pharmaceutical Manufacturers.

The affiliation provides NAMAX with an integrated pharmaceutical value chain, which includes NCPC, CSPC, KELUN, REYOUNG, JIHENG, BIOCHEM (ARVs), LUKANG (Antibiotics) and HONGQI. These strategic partners have a total network of 32 facilities, which are all accredited by the NMRC.

The company currently imports its products from around 25 Chinese pharma companies for distribution and supply in Namibia, the products and services include:

Pharmaceuticals

BP, USP and EP standards;

ARV;

Anti TB medicines;

Anti Malaria medicines;

Gastrointestinal medicines;

Analgesics;

Rheumatic medicines;

Anti-diabetic medicines and antibiotics.

Medical consumables

CE and/or SABs certificates.

In-Vitro diagnostic kits

WHO pre-qualified and/or CE;

HIV rapid test kit and Malaria rapid test kit.

Medical devices/equipment (CE and/or SABs certificates)

The Need in the Market

The commercial value of the Namibian healthcare industry was estimated to be NAD 15.7 bn (USD 1.07 bn) in 2016 and NAD 17.2 bn (USD 1.32 bn) in 2017. This represents 9.7% growth rate in NAD terms (BMI Research, 2018).

Pharmaceuticals constitute about 16 percent of the entire healthcare industry. The Pharmaceuticals sector in 2016, was estimated at NAD 2.54 bn (USD 173 mn) growing to NAD 2.76bn (USD 212 mn) in 2017, representing an 8.7% growth in NAD terms (BMI Research, 2018).

Namibia imports more than 98% of its pharmaceutical and medical consumables requirements. However, the industry is almost entirely controlled by South African-based pharmaceutical manufacturers and intermediaries of multinationals such as Pfizer and GlaxoSmithKline, which supply more than 70% Namibian market through these channels.

Moreover, the Namibian legal framework also presents entry barriers to entry, for companies outside the established channels. According to the Medicines and Related Substance Control Act 2003, only those medicines registered by the NMRC can be distributed legally in Namibia.

The opportunity in the Market

There is a wide gap in the demand and availability of cheap and quality medicines in Namibia and the world over.

Generic medicines and off patent drugs have significant potential to increase access to cheap and effective medicines to low income groups and in general to bridge the demand supply gap.

NAMAX modern pharmaceutical plant can play a significant role in increasing access to affordable off patent medicines.

There is only room for one modern Oral Solid Dosage plant in Namibia, to cater for our 2.3 million population. This is in line, with the standard practices of having 1 manufacturing plant to every 2 million people, in countries like China and South Africa.

Therefore, it makes economic sense to establish an Oral Solid dosage factory in Namibia. As it will be viable for the next 10 to 15 years.

The Oral Solid Dosages are also the main dosage form commonly used in Namibia and SADC, and constitutes a majority share of the local Pharmaceutical market. As such, NAMAX can easily dominate the local market, when the local Oral Solid Manufacturing Plant is set up.

The manufacturing plant will also aim to capitalizing on and support the government’s Growth at Home Strategy and Industrialization efforts. As well as, enjoy the investment and tax incentives available to manufacturers such as EPZ status, Infancy Industry Protection (IIP), and a reduced corporate tax of 18%.

The Business Concept

Going forward NAMAX strives to be the first modernized pharmaceutical manufacturer in Namibia and subsequently become the leading supplier of pharmaceutical products and medical consumables in Namibia and gradually become one of the main suppliers in the SADC region.

The plant is developed with comprehensively technical support of NCPC (North China Pharmaceutical Co., Ltd, a WHO/EU GMP accredited pharmaceutical manufacturer) and REYOUNG Pharmaceutical Co., Ltd (an EU GMP accredited pharmaceutical manufacturer).

This plant will have the capacity to produce more than 1 billion tablets/capsules per annum. The products will include ARV tablets such as Lamivudine & Zidovudine and generic drugs such as Paracetamol.

NAMAX aims to improve Namibia’s competitiveness, by introducing technologies, capacity and synergies that will move us from a pharmaceutical importing country to a net pharmaceutical goods exporter.

The plant will also result in the direct employment of at least 150 technical employees and will work in cooperation with UNAM School of Medicine to provide industrial attachment, research & development competencies and technical expertise in the pharmaceutical value chain.

Vision

Namax strives to be the first modernized pharmaceutical manufacturer in Namibia and subsequently become the leading supplier of pharmaceutical products and medical consumables in Namibia.

Mission Statement

“We are committed to enhancing human health and well-being by providing quality pharmaceutical products and medical consumables, manufactured in full compliance with global quality standards. We continually strive to improve our core capabilities to address the unmet medical needs of the patients and to deliver outstanding results for our shareholders.”

Objectives

Develop and build an Oral Solid Dosage manufacturing plant in Namibia so as to produce tablets/capsules locally.

Actively market the products in the country and in a short time achieve the main supplier status for both public and private sectors. As well as, bring better results to its shareholder.

Technology transfer partnerships between local companies and external partners.

The plant will provide a base for UNAM Pharmacy students to acquire practical manufacturing competences.

“We actively take part in initiatives that benefit the Namibian society and contributes to public health and welfare of the Namibian people. We take great care in our operations with high concern for safety and environment.”

Competitive Landscape

The Namibian pharmaceutical/medical Market size is around USD 1.3 billion comprising of Medical treatment services (USD 1.0 billion), Pharmaceuticals (USD 212 million) and Medical consumables (USD 100 million).

Currently there is only one pharmaceutical manufacturer in the country which is FABU Pharm which was established in 1989, however, FABU mainly manufactures topical dosages and few oral solutions.

There are 18 pharmaceutical wholesalers in Namibia, the big players are EROGO Med, NAMPHARM and GEKA. They control 70% of the market share and the other 30% is shared by other players.

Preliminary Work for Local Oral Solid Dosage Manufacturing Production Plant

A piece of fully-serviced industrial land measuring 10,340 square meter was acquired.

The preliminary floor design for the local plant completed.

The pharmaceutical products for locally manufactured were screened.

The pharmaceutical expertise (including pharmaceutical manufacturing, quality assurance and mechanics) were recruited.

Equipment for pharmaceutical processing, air conditioning, water purification and quality control were screened.

The preliminary environmental assessment application report was drafted.

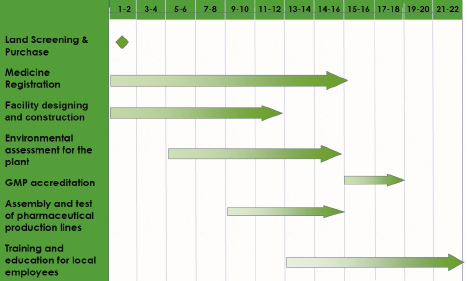

The estimated timeline will be 18 months from plant construction to obtaining Pharmaceutical Manufacturing License issued by the NMRC, see the timeline.

Timeline of Milestones (in months)

Financial Assumptions and Returns

The pharmaceutical markets include Angola, Zambia and Zimbabwe, however, we will use conservative estimate of 5 years to recover all cost even based on the pharmaceutical/medical market in Namibia.

Namax Value Proposition

NAMAX Pharmaceutical (Pty) Ltd to contribute the followings:

Bring in assets and intellectual property for setting up and maintaining the local pharmaceutical plant.

Taking in charge designing and Environmental Assessment of the local plant.

Designating no less than 5 experts experienced in pharmaceutical manufacturing for the construction/operation of the pharmaceutical plant in Namibia (including expertise in production management, quality management and machine maintenance).

Guarantee the technical transfer of pharmaceutical production from China to NAMAX and making sure the qualified pharmaceutical products to be manufactured by NAMAX in Namibia.

Guarantee at least 30 pharmaceutical products are approved and listed on NMRC medicines registry.

Compilation of production management system for the new plant.

GMP accreditation of the facility by the NMRC.

Training/education of local technical workers.